With cashless payments becoming widespread these days, are you using such convenient payment methods? I don’t use them much myself, as I’m not familiar with any cashless payment methods in Vietnam besides credit card payments. However, I see many people using cashless payments. I believe this convenience is influencing your consumption behavior.

First, psychology has a term called the “pain of paying.” This refers to the phenomenon where the act of actually paying money to purchase goods or services causes psychological pain or discomfort for us consumers, much like the “pain of feeling your wallet get lighter.” The degree of this “pain” varies significantly depending on the payment method, timing, and the size of the amount. (1) In other words, the absence of physical cash exchange makes even large payments feel minor. For example, wouldn’t you agree that cashless payments feel more convenient than counting out 1000k (VND) in cash? This phenomenon is called the “pain of paying.”

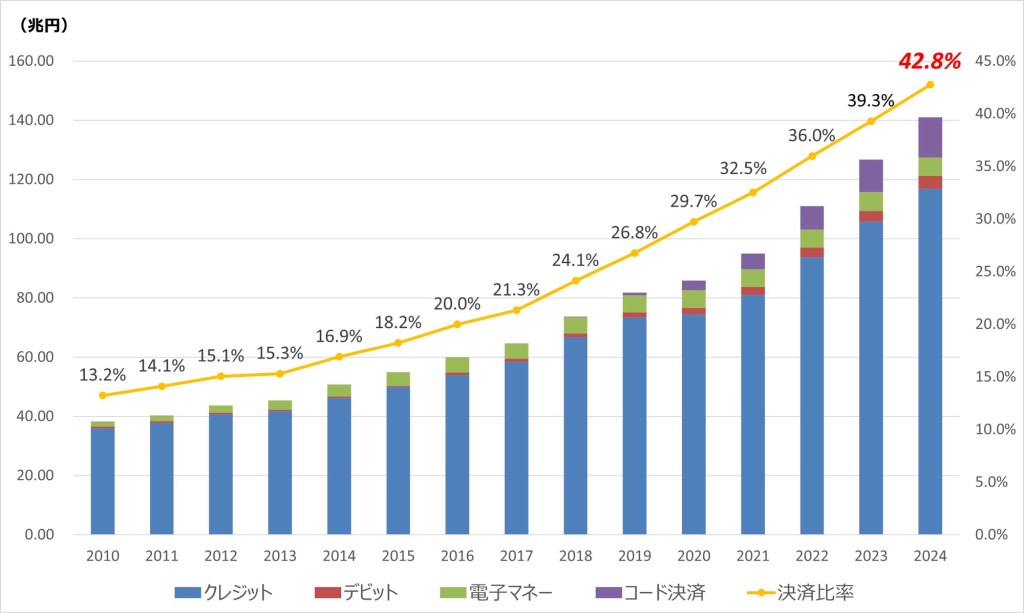

Next, here is a graph showing cashless payment amounts based on a survey by Japan’s Ministry of Economy, Trade and Industry. (2) In 2016, it was 20%, and in 2024, it reached 42.8%. We can see it has nearly doubled. This indicates that cashless payments are becoming more widely used, and people are spending significantly more money.

Finally, let’s touch on the benefits brought by the spread of cashless payments. They significantly contribute to reducing labor costs. This is because they eliminate the hassle of closing out registers and preparing change. Additionally, they cut costs associated with transporting cash. Since cashless transactions are recorded, manual calculation errors decrease. Furthermore, electronic coupons are easier to use. People tend to let paper coupons expire, but electronic coupons can be used casually.

If cashless payments become more widespread, cash-related crimes will decrease. This is because as more people stop carrying cash, fewer people will commit robbery or theft. There are many benefits like this.

However, I also considered the drawbacks. If cyberattacks or data breaches occur, can we truly say cashless payments are secure? If it happens, it would be frightening. Additionally, if a disaster strikes, could we, who depend on this system, survive without cash? In today’s world, it’s wise to carry cash alongside using cashless payments.

Considering the psychological concept of “pain of paying” discussed above, and the fact that cashless payment amounts are rising, we should exercise caution when using convenient cashless payment methods.

notes

(1) https://www.360vr.co.jp/blog/behavioral-economics/pain-of-paying

(2) https://www.meti.go.jp/press/2024/03/20250331005/20250331005.html

Leave a comment