Understanding how energy shocks influence supply chains, costs, and competitiveness is essential for navigating the modern global economy.

The Reasons Behind EU’s Rising Energy Pressures

Europe, of 2025, is once again facing a serious energy challenge (since 2022) and fears of shortage. This situation is not happening in isolation, however, the whole world is feeling the pressure of unstable energy markets.

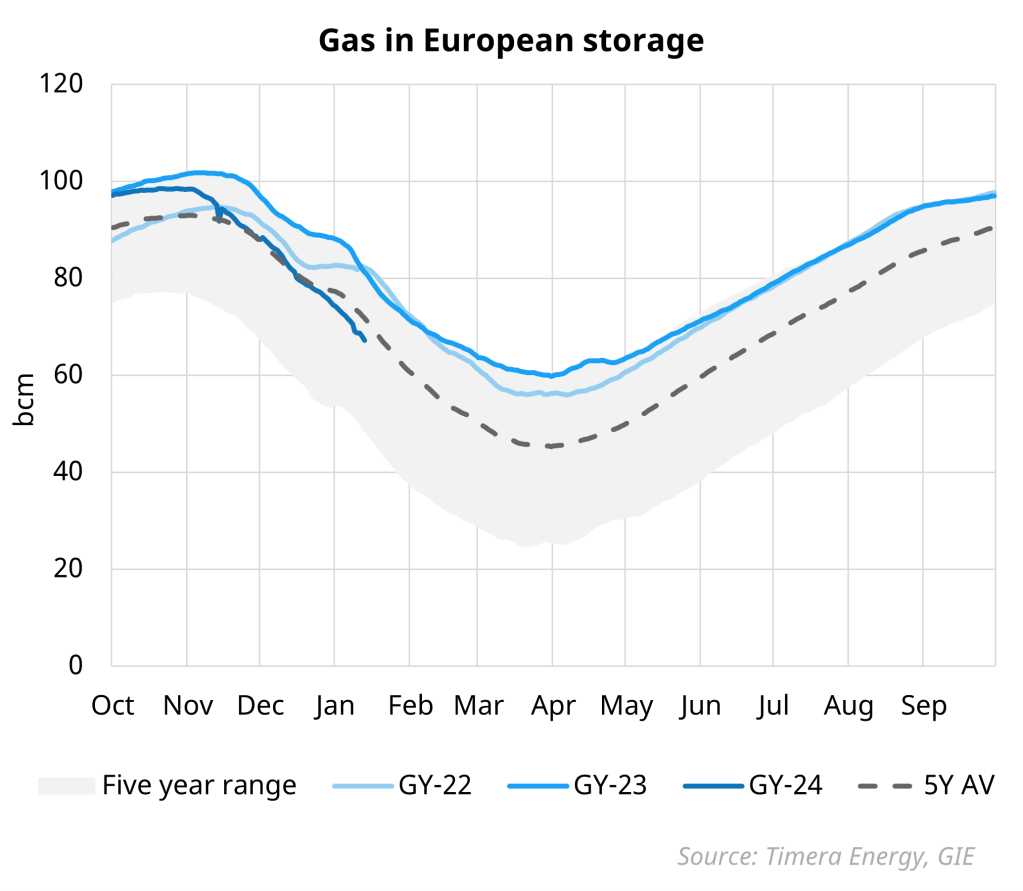

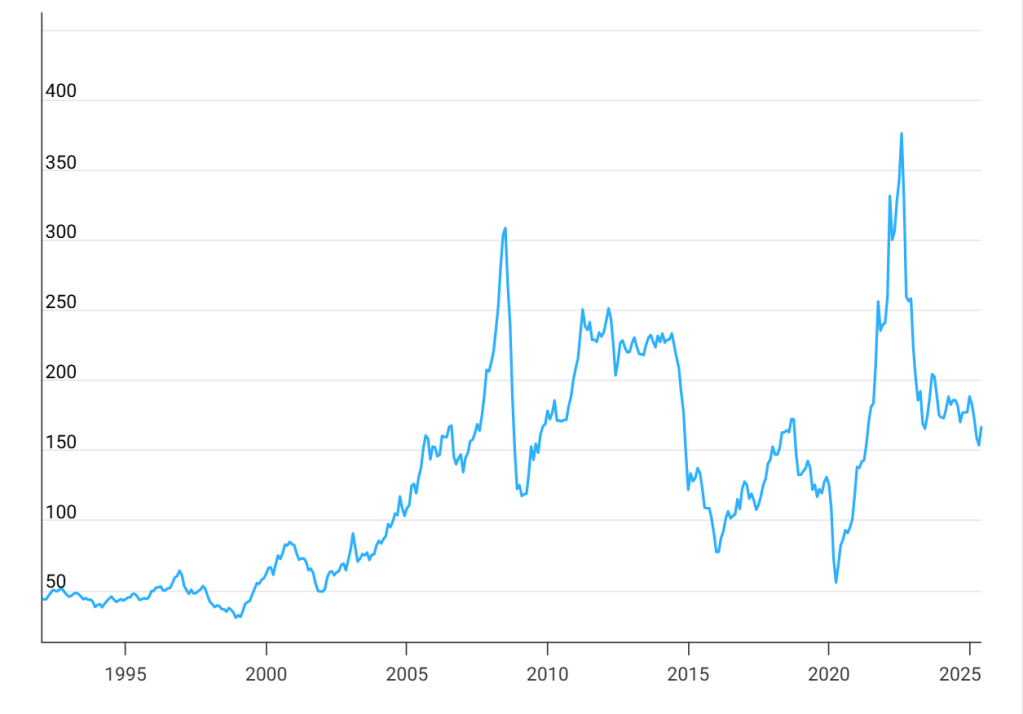

After years of global recovery from the historical pandemic and the war in Ukraine, many countries reduced gas production while demand kept growing. Unexpectedly cold winters in early 2025, led to an increasing in energy use for heating, while renewable sources, like wind and solar, couldn’t meet the full demand. At the same time, tensions in the Middle East and supply issues in Africa limited gas shipments to Europe. All these global factors combined to make the EU’s energy system vulnerable again.

European gas storage levels depleting fast – Timera Energy

The Global Ripple Effect

When Europe faces an energy crunch, the rest of the world feels it too. Rising European demand pushes up global gas prices, affecting Asian and American markets. Developing countries that rely on imported energy now pay more, worsening inflation and slowing growth. For businesses, higher energy costs mean more expensive production, transportation, and materials everywhere — not just in Europe. Some European companies are even moving factories abroad to save costs, changing trade patterns worldwide.

Long-Term Outlook

Despite short-term difficulties, this crisis is both a warning and an opportunity. It has pushed Europe to accelerate its transition toward renewable energy. Investments in wind, solar, and green hydrogen are growing rapidly, supported by EU-wide initiatives to reduce dependence on imported fossil fuels. This shows that energy security and sustainability must go hand in hand. If Europe and other regions continue to invest in clean and reliable energy, these efforts could make the continent more energy-secure and environmentally sustainable in the next decade; therefore, the world can partly avoid similar shocks in the future.

“Ensuring the security of energy supply remains a critical challenge for the European Union, particularly in light of Russia’s long-term weaponisation of energy, its war of aggression against Ukraine, the resulting geopolitical shifts, and the urgent need to diversify our energy sources while investing in domestic production” said lead MEP Beata Szydło (ECR, Poland).

Leave a comment