Sophisticated private sources could provide a fuller picture of the state of the economy. But the government is not even trying to use them.

Why Nobody Trusts Government Economic Data Anymore (And It’s Actually Getting Worse)

Here’s something that’s been bugging me lately: we’re living in the most data-rich era in human history, yet somehow, the government’s economic statistics feel less reliable than ever. It’s like having a smartphone in your pocket while your boss still insists on using a fax machine.

Last week really drove this home for me. The Bureau of Labor Statistics casually announced they’d miscounted jobs by—wait for it—911,000. That’s not a typo. Nearly a million jobs that supposedly existed just… didn’t.

Look, I get it. Revisions happen. But when your margin of error is bigger than the population of several states combined, we’ve got a problem.

So What’s Actually Going Wrong?

The cracks started showing years ago, but now they’re turning into canyons. Remember when you could actually get people to respond to surveys? Yeah, those days are gone.

Take the Current Population Survey, which is supposed to tell us about employment and demographics. Response rates have tanked from 88% in 2015 to just 68% today. Consumer spending surveys? Even worse—they’ve crashed from 68% all the way down to 40%.

Now here’s where it gets really messy: people aren’t refusing to participate randomly. Lower-income folks are dropping out faster than everyone else, which means official data is increasingly reflecting what’s happening with wealthier Americans. The Census Bureau quietly admitted that since 2020, they’ve been overstating median household income by about 2-3% because of this exact bias.

And honestly? I can’t blame people for not responding. If the administration is going to call government data “junk” anyway, why bother filling out another survey?

The Time Travel Problem

But wait, it gets better (or worse, depending on how you look at it).

By the time official economic data reaches policy makers, the economy has already moved on. The Fed’s big wealth survey? Conducted every three years, and results drop 18 months after they start collecting data. So the 2025 survey results won’t be available until late 2026. That’s basically ancient history in economic terms.

Think about that 2008 financial crisis for a second. The recession officially started in December 2007, but economists didn’t confirm it until December 2008. That’s a full year of economic pain before anyone in power officially acknowledged what was happening. By the time Congress passed stimulus in February 2009, we were 14 months into the crisis.

Could we have prevented some of that damage with faster, better data? Absolutely. But instead, we were flying blind.

The Real Kicker: We’re Starving the Data Agencies

You know what really gets me? While all this is happening, we’ve been systematically defunding the agencies responsible for collecting this information. Since 2009, statistical agencies have seen their budgets cut by 14% after adjusting for inflation.

The consequences are exactly what you’d expect. The Bureau of Economic Analysis stopped tracking self-employment by industry and county-level employment. The Bureau of Labor Statistics dropped price tracking for 350 product categories and cut back on Consumer Price Index data collection in multiple cities.

We’re essentially asking these agencies to do more with less, during a time when we need accurate data more than ever. It’s like telling a fire department to handle more emergencies with fewer firefighters and broken equipment.

The Irony That’s Driving Me Crazy

Meanwhile, hedge funds are making billions by tracking the economy in real-time using private data sources. They’re not waiting for government reports—they’re looking at:

- Real-time payroll data from companies like ADP

- Credit card transaction records (anonymized, of course)

- Satellite images counting cars in Walmart parking lots

- Redfin’s weekly housing market updates (which are apparently accurate to within 2% of actual sale prices)

During COVID, Harvard economist Raj Chetty built a dashboard using private data that tracked economic changes weeks before official government statistics caught up. It wasn’t some massive government project—just smart use of existing private-sector data.

So the technology exists. The data exists. We’re just… not using it.

The Pushback (And Why I Think It’s Overblown)

Now, government officials will tell you private data has problems—lack of transparency, potential bias, companies might change methodology or put data behind paywalls. And look, those are fair concerns.

But here’s my take: not using this data because it’s imperfect is like refusing to use GPS because paper maps are more reliable. Nothing’s perfect, but we need to be pragmatic here.

Research has already shown that combining official BLS numbers with ADP’s private payroll data actually reduces errors from both sources. It’s not about replacing government statistics—it’s about making them better.

What I Think We Should Actually Do

This shouldn’t be complicated or controversial. We need a hybrid system that:

Keeps doing traditional surveys for historical continuity and methodology, but integrates real-time private data that’s been properly vetted and documented. Then publish preliminary estimates using the private data, followed by refined numbers from traditional surveys later.

Most importantly, we need to properly fund statistical agencies so they can actually analyze and verify all this information.

Why This Actually Matters to You

I know this might sound like wonky economics stuff that doesn’t affect your daily life. But think about it: every decision about interest rates, unemployment benefits, stimulus checks, inflation adjustments to your salary—all of that depends on accurate economic data.

When the Fed raises interest rates based on flawed employment numbers, your mortgage gets more expensive. When stimulus arrives 14 months too late because we couldn’t detect a recession in time, that’s real families suffering unnecessarily.

We’re literally making trillion-dollar policy decisions based on information that’s months old and increasingly unreliable. That should worry everyone.

The Bottom Line

Right now, we’re living in an absurd situation where private investors have better, faster information about the American economy than the government officials making policy decisions that affect all of us.

The technology to fix this exists. The data exists. What we’re missing is the political will to actually modernize how we measure economic reality.

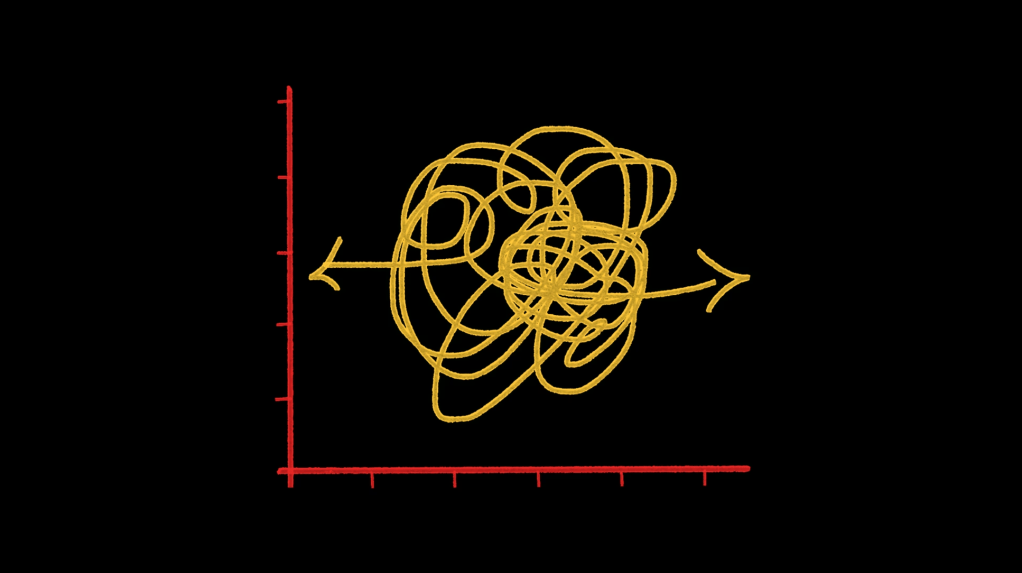

Until that changes, we’re basically driving into the future while staring in the rearview mirror—and we shouldn’t be surprised when we crash into things we didn’t see coming.

Reference

https://www.theatlantic.com/economy/archive/2025/09/economic-data-crisis-bls/684238/

Leave a comment